Conversational marketing and your financial organisation

Conversational marketing has been a buzz phrase for a few months, and for good reason, but what is it anyway and can it help your financial organisation? Simply put, conversational marketing is… conversations. We don’t think much of conversations, often looking down on them from our towers of lead generation and conversion rates, but it’s quite possibly the most powerful form of marketing out there. Our world is full of conversations, as they are the lifeblood of all communication. Every email you type, every text you send, every status update, it’s all conversational. So why not take that same human approach with marketing?

The power of conversations is apparent, but how can you use it to drive your conversions and generate revenue, without making your target market feel overwhelmed? It’s simple, conversational marketing, if used as an inbound method, is much more impactful for your brand. A real-life example is the difference between a polite customer service representative in a clothing shop and a peddler outside of a busy train station. Both of those examples can be used for the same brand, but it’s guaranteed to leave very different impressions on the target market. When a potential customer enters a shop and is greeted politely, a positive impression is left on the customer, but when a potential customer is approached politely outside of a train station but they didn’t make the first move, it can leave a negative impression. The customer has the power in this scenario, but it’s our job to work around that power dynamic.

Now that today’s world has forced a digital shift and online shopping is much more preferable for both product and service based businesses since the start of 2020, it’s time to look at how your financial organisation is using conversations in marketing. How are you greeting customers online? Are you allowing them to “walk” into a shop with no customer service representatives to assist unless they fill out a form or make an application to speak with someone? It sounds silly when presented that way, but it is how websites have become. Customers are looking online now more than ever before, and they stick with brands that have better communication and higher convenience levels, not strictly brands that are price competitive.

How to make your brand more conversational?

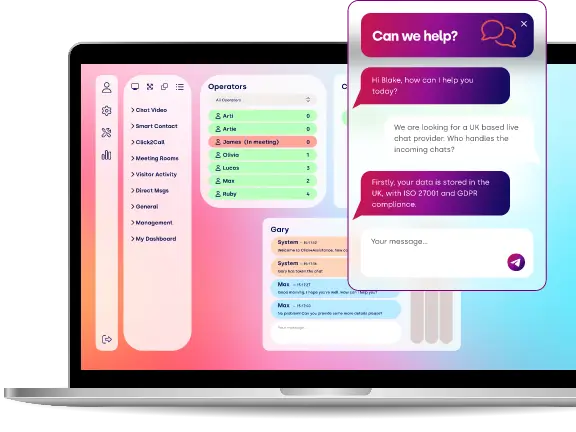

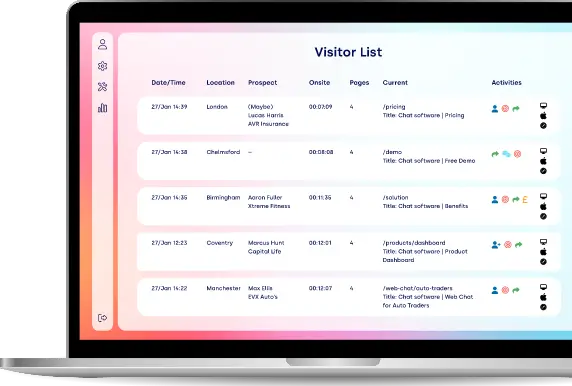

Live chat, such as Click4Assistance the best live chat provider in the UK, is one of the most effective ways of making your website more customer friendly. It’s simple to set up, easy to use for both the customer and your financial organisation’s customer service agents, and it’s very cost effective. Statistics show that one in four customers who use live chat convert to a purchase. Live chat directly improves revenue generated on your website.

When you stack your live chat with artificial intelligence, like Click4Assistance’s Artie, it makes a dramatic difference. Artie can greet every incoming website visitor, answer basic questions, and help your customers with website navigation, making your agents more productive since they will be focused on more complex customer issues. Artie and Coni, Click4Assistance’s chatbot and formbot, are designed to engage your incoming website visitors, start a conversation, and encourage a conversion. This is how your financial organisation can automate conversational marketing without adding any additional team members, while increasing your potential revenue from your website and your overall brand equity.

If you’re interested in deploying Click4Assistance, the UK’s premier GDPR compliant live chat software solution, to make your financial agency more effective in 2020, give us a call on 0845 123 5871 or send an email to theteam@click4assistance.co.uk and one of our experts will be with you right away. Not ready to reach out yet? Discover how it works, try a demo, or better yet, try Click4Assistance completely free for 21 days.