Council Tax Mayhem

Local authorities get incredibly busy around council tax bill issue time. In this guide, we’ll discuss effective steps councils can take to streamline resources and increase efficiency.

Introduction

The end of March is one of the busiest periods in the calendar for local authorities. As councils prepare to issue council tax bills, workloads increase. In 2020/2021, local authorities in England issued more than £24 million council tax bills, generating more than £30 billion in council tax. Council tax plays an integral role in funding public services. In the aftermath of the pandemic, pressure on councils is high and many residents are facing challenges. It has never been more important to implement streamlined processes to communicate with council tax bill recipients and collect council tax revenues. In this informative article, we’ll explore some steps councils can take to simplify systems and achieve better results.

The importance of communication

Communication is key to successful council tax bill preparation and tax collection. Councils start to prepare to issue bills long before the end of the financial year, but March and April are busy months when residents are most likely to have queries or concerns about their tax bill or how to pay outstanding debts or cover payments that may not be affordable for them in the future. There are various ways councils can communicate with residents, but the process of getting in touch and gathering useful information or advice is not always straightforward. To cover all bases and ensure that everyone is able to contact the council or find the information they need, it’s beneficial to offer a range of options, including:

- Local authority websites: Local authority websites are often the first port of call for residents who would like information about their council tax bills and those who have questions or concerns. Websites usually have an FAQ section and articles and guides, which cover the main issues linked to council tax.

- Telephone lines: Telephone lines offer the opportunity to speak to members of staff at the council, but they can get busy. Trying to contact the council by phone may involve significant waiting times. Staff can only handle one enquiry at a time.

- Online enquiries: Many local authority websites have online enquiry services, which enable residents to submit queries via the website. Often residents don’t know when to expect a response which can lead to unwanted stress.

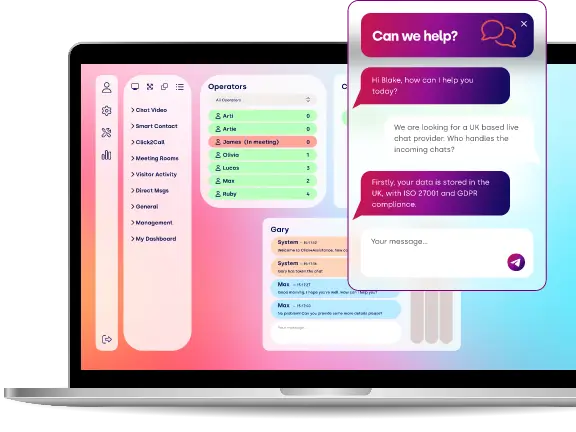

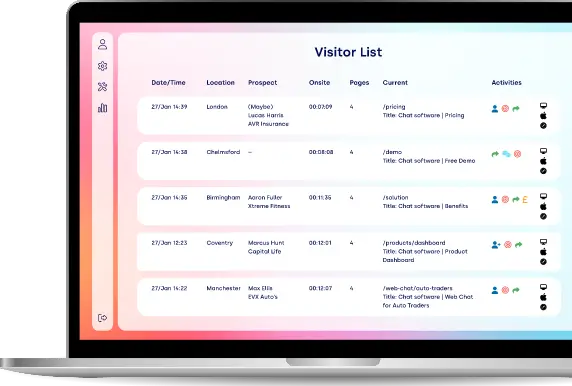

- Live chat: Live chat has transformed customer support and service in recent years. With access to a live chat website, councils can field enquiries quickly and efficiently and customers can get the information or help they need without holding for long periods or calling multiple numbers. Using live chat services also offers a cost-effective solution for councils as advisors can handle multiple enquiries simultaneously.

- In-person appointments: Some local authorities offer in-person appointments, but this is not always convenient for residents, especially those who find it difficult to get around, and it can take up valuable time for teams during busy periods. In many cases, issues could be resolved faster via live chat, online enquiries or phone calls.

Best practice guidelines for streamlining resources

At a time when council teams are flat out preparing council tax bills and getting ready to handle enquiries from residents, streamlining resources is crucial. Here are some best practice guidelines that can benefit local authorities:

- Utilising effective systems to calculate discounts and protect vulnerable households: councils employ Local Council Tax Support schemes to reduce tax liabilities for vulnerable households and residents on low incomes. To protect residents and ease anxiety linked to paying council tax bills, councils can be proactive in calculating discounts and communicating with households that qualify for discounts or additional support. Different departments can work together to ensure that residents have access to the relevant exemptions or reductions.

- Streamlining debt: some councils are implementing new guidelines to create a single payment, which replaces multiple debts. Councils can help residents who fall into arrears by simplifying payments, providing information about consolidation and signposting to organisations or departments that can offer additional assistance.

- Pooling resources: councils have the opportunity to engage with other councils across all tiers and locations to pool resources, save money and boost efficiency. Sharing resources, data and innovative new measures and systems can help to improve processes.

- Taking advantage of technology: screen time is increasing year on year and the majority of people now have access to a smartphone or a device, which is connected to the Internet. Taking advantage of technology, such as live chat, can be a game-changer for councils and residents looking to speed up the process of accessing advice and providing or locating useful, helpful information.

Summary

Local authorities are approaching one of the busiest times of the year, with council tax mayhem on the horizon. As councils prepare to issue millions of tax bills, streamlining systems and resources is essential.