Does your financial organisation understand how direct message chat integration can increase sales?

Imagine being able to chat with your financial institution through WhatsApp chat integration, rather than spending ages on the phone waiting to speak with an available customer service agent. That sounds like bliss to a lot of people. The convenience factor alone weighs out any risk related worry. The truth is, the world has become a very busy place thanks to the prolific rise in mobile technology. Every minute, we experience a ping, ding or ring that drags our attention from one task to another, forever dissecting our attention into a million places to keep on top of the ever growing mountain of work that needs to be done.

While our mobile devices bring us some chaos, they can also bring us some calm and productivity. Our emails and various methods of communication are amalgamated onto one device, so we don’t have to wait until Monday to check our inboxes or work messages - we do it now. The speed at which we can work and communicate compared to 20 years ago is phenomenal.

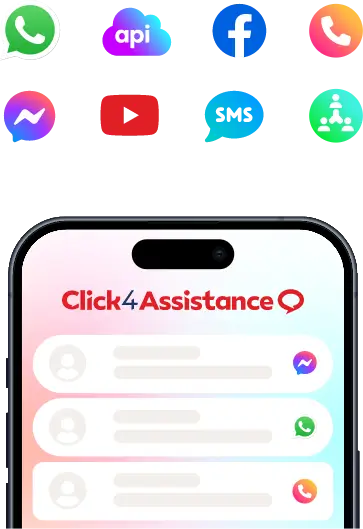

Increasingly more companies are jumping into direct message chat integration to keep in touch, rather than have customers contact them strictly through their own platforms, simply because their customers are already familiar with their direct messaging platforms and they exist on their devices as well. The convenience of this provides no barrier to entry, and it’s a fantastic way for companies to keep in touch with their customers in a much more personal way.

At a glance, direct message chat integration does not seem that it can impact sales on a meaningful level but it does in more ways than one. Firstly, your customers will appreciate the intimacy your financial organisation has with them. We live in a very busy world and everything has become very impersonal, because everyone is so busy. Work communication has whittled down into short or abbreviated direct messages in a WhatsApp group rather than a catch up meeting or a memo. So when you provide a one on one private conversation and develop a deeper relationship with your customers, they will pay attention and appreciate that, much more than being treated like a number.

Secondly, a stronger customer-company relationship will yield higher sales overall. If your financial organisation has a better relationship with your customers, they will be more loyal to your brand because they are happy with their level of service, even if a competitor is cheaper.

Thirdly, these customers will tell their friends, and then those friends will tell their friends, and suddenly, you have gained more customers by having a better customer experience. All of these possibilities opened by just adding in direct messages into your customer service communication strategy. Direct message chat integration is one of the more important integrations with your live chat software, given the direction of the world’s communication trajectory.

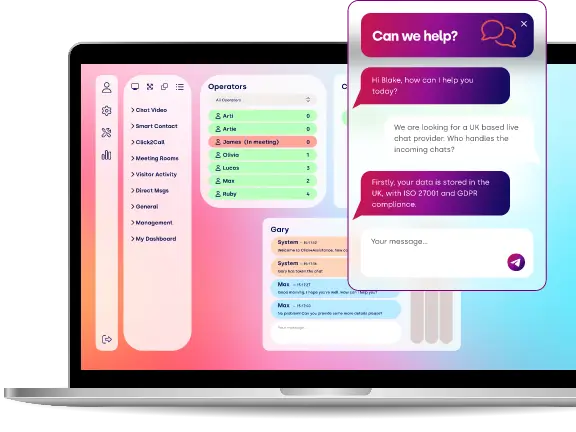

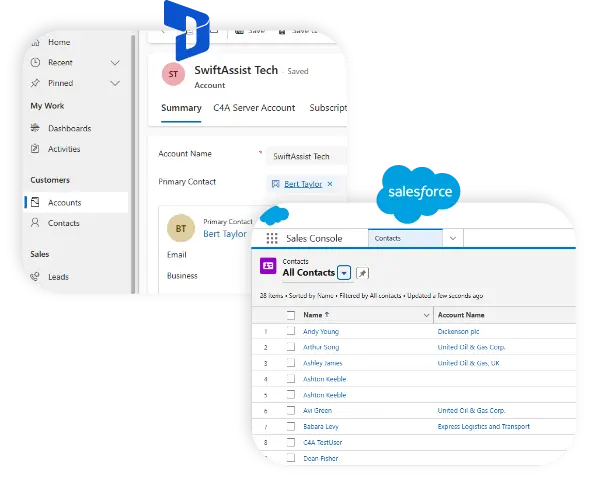

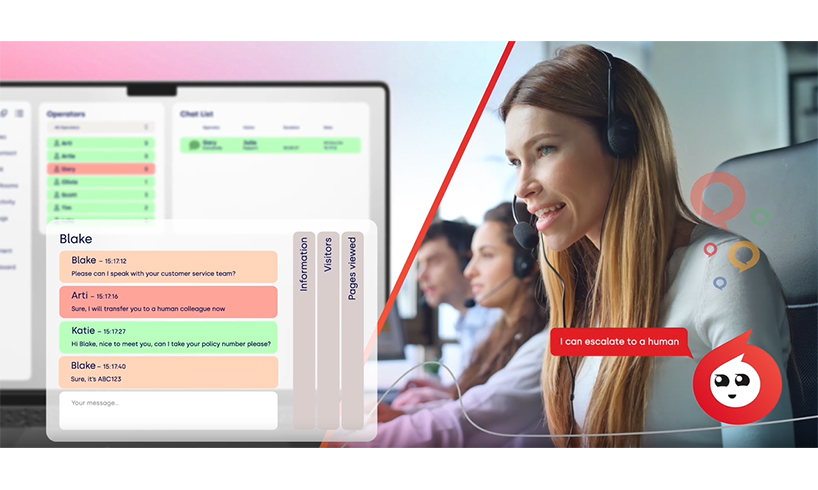

But if you want to start effectively communicating, you also need to invest in the right software. Click4Assistance is the most reliable and efficient software solution in the UK market for customer service, and they have been supporting financial organisations like yours for over 15 years. You can rest assured that their competence and security protocols are exactly what your business needs, especially in times where businesses need to digitally transform and upgrade to cloud based software services, rather than locally based solutions. Click4Assistance has everything your financial organisation needs to boost your customer service productivity and increase your sales potential. If you’re interested in deploying Click4Assistance, the UK’s premier GDPR compliant live chat software solution, to make your financial agency more effective in 2020, give us a call on 08451 235 871 or send an email to theteam@click4assistance.co.uk and one of our experts will be with you right away. Not ready to reach out yet? Discover how it works, try a demo, or better yet, try Click4Assistance completely free for 21 days.