Insurance Companies Expected to Grow Live Chat Operations 50% by 2020

Within the next year, UK insurance companies are expected to significantly invest in AI-enabled live chat, automated customer identification, and interaction analytics technology.

ContactBabel recently undertook a survey of over 200 UK contact centres. The report’s author, Steve Morrell, Principal Analyst, said: “With average call lengths in UK insurance contact centres having risen by over 60% since 2010, the industry has embraced the opportunities that digital channels can bring, especially in terms of automating simpler interactions.

“AI-enabled web chat can handle a large proportion of straightforward customer requests, while automating the customer identity process will shorten call times and reduces fraud. The insurance sector has also seen very significant rises in the average time taken to answer calls, as well as the length of calls. The significant growth in digital activity, particularly email, shows that insurers are understanding how their customers wish to contact them, while managing the cost of service.”

The report showed that there has been an 8% rise in inbound email interactions with insurers, from 7% in 2012 to 15% today. Digital channels are preferred by customers and are anticipated to increase further, with insurance operations expected to grow their use of live chat from 44% today to 94% by the beginning of 2020.

The use of interaction analytics is expected to rise to 43%, as is automated speech recognition, with much of the latter being used to reduce fraud and the time required to take phone customers through security.

Live Chat within Insurance Companies

The majority of insurers will implement live chat across the entirety of their website, allowing all types of enquiries to be handled via chat and reduce the pressure on phone lines. This method of integrating the instant communication channel usually entails a central team who are trained in the multiple areas of cover and services. A few examples of insurance companies using live chat in this manner are Complete Cover Group, Grove and Dean, and Questor Insurance.

"Frequently these software companies are fairly faceless. Not with Click4Assistance. Brilliant Customer Care, you can always speak to someone instantly with any queries and they are only too happy to help. Importantly also they are very often an expert in the field. That’s before talking about the software which does more than the job and helps us with our constant quest to find new ways of interacting with our clients. Recommend the company and its software to anyone" – Head of Marketing, Questor Insurance.

Some insurers will expand on this type of implementation by including a proactive approach. Not only does Business Choice Direct have a reactive button across their website, they also have a proactive invite that prompts the visitor to start a chat by displaying an image to the individual after a certain period of time. A Proactive invitation has been proven to increase chat uptake as it grabs the enquirer’s attention and makes them aware of the chat service.

Other insurer’s implement live chat for websites more specifically to areas they have identified that will benefit from the instant communication channel. Angel Risk Management has integrated live chat to their website over 12 years ago. The service has been implemented onto their ‘QuickQuote’ page, allowing visitors to contact their business development, IT, new business, renewals, and terrorism departments at any time during the quote process. Having a department selector enables visitors to be connected directly to the team they require help from, which increase first contact resolution rates.

Another insurer that has implemented live chat in a particular manner is Go Skippy, who has integrated the chat service as a method of contact within their help panel. Their customers have to select a specific path for the live chat to appear as an option to them helping the insurance company to manage the type of enquiries they receive via the communication channel and improve their operations.

‘We introduced live chat to our business nearly two years ago and it has been a huge success. It has really helped us reduce our call volumes. Our customer service staff love using it and our customers are really benefitting from the service. The set up was simple and has worked smoothly ever since!’ – Go Skippy’s Digital Marketing Executive.

Introducing AI into Insurance Companies

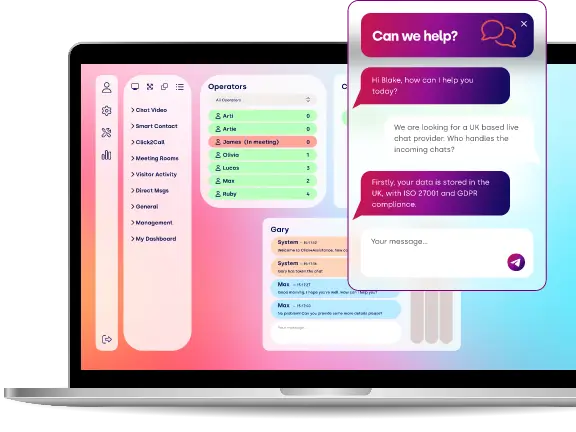

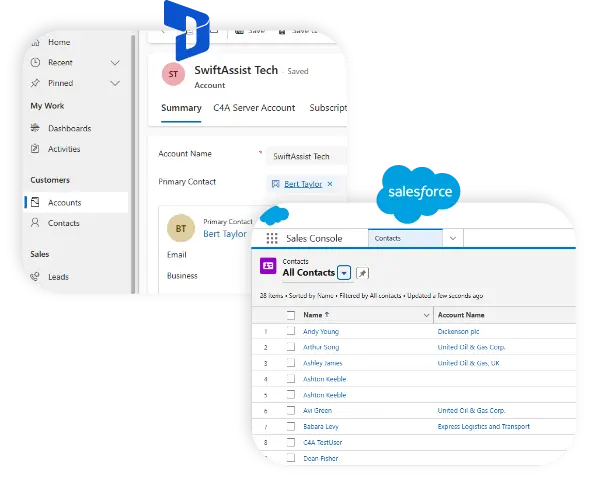

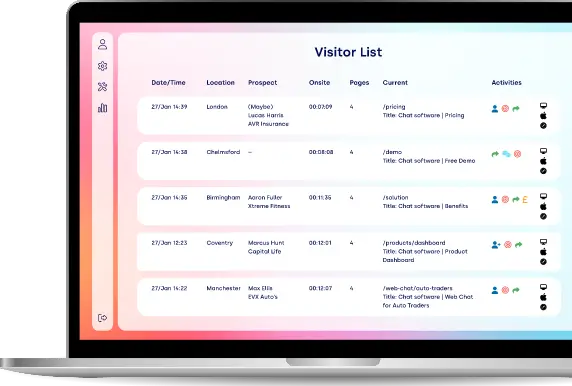

Click4Assistance has recently introduced our chatbot to the public; insurers can implement AI to prequalify a visitor before the conversation is referred to a human operator. This reduces the time that the representative spends asking security/identity questions before they can actually advise a customer.

For example, an insurance company can use a chatbot to ask visitors questions such as:

- What would they like to do? (Purchase a policy, renew a policy, change a policy etc.)

- What type of insurance? (car, van, bike or home)

- How many years no claims do they hold?

Another way that AI can be integrated into insurer’s live chat system is that the chatbot can answer frequently asked questions. For example, an insurance company’s frequently asked questions may include:

- What insurance products do you offer?

- What levels of cover are there?

- What are classes of use?

Allowing a chatbot to answer these types of questions reduces the involvement of a representative. In most cases they are repeating the information already available on the website, and therefore automating this saves the organisation’s resources for more in-depth enquiries.

Implementing Live Chat into Your Insurance Website

Click4Assistance has been providing live chat for websites to insurers for over 10 years, helping them to successfully reduce call volumes and improve customer satisfaction rates. For more information on how live chat or AI can benefit your organisation contact our team on 01268 524628.