Live chat in the finance industry

Discover why live chat is transforming the finance industry, and how it can help you, too.

Live chat is starting to take a central role in the finance industry. As firms digitise, they are seeking novel communication channels that customers love and want to use. It’s all part of a movement towards personalised banking that began with ATMs in the 1970s.

Despite the challenges of setting up a financial institution from scratch, the force of competition is compelling firms in the sector to improve their services. New “fintech” brands are arriving all the time, promising customers ever-more convenient services and arrangements.

Because of this, banks need to improve their chat capabilities. Clients want to be able to chat with them at any time, about any issue

This post explores some of the ways you can use live chat to grow revenue. Here’s what you need to know:

Give Clients Instant Answers

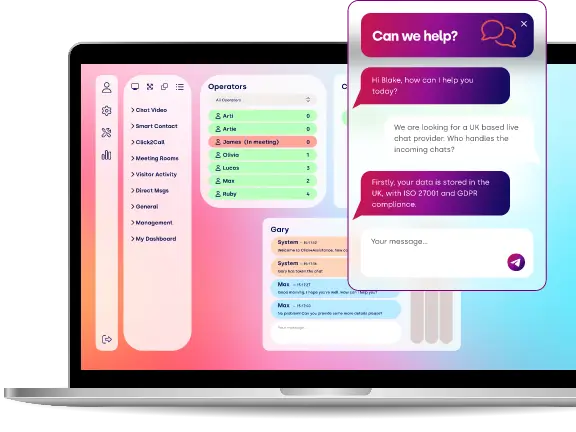

First, live chat gives you the ability to respond to clients instantly. As soon as visitors have a question, you can provide them with an answer, no matter how busy your reps are.

How? Because chatbots can now resolve a significant percentage of customer queries straight away.

For instance, if a customer incorrectly enters their PIN three times, the credit card will automatically block itself. They then have to go to an ATM to unblock it manually. A customer service rep could provide this information, but it’s much easier for a chatbot to do it instead.

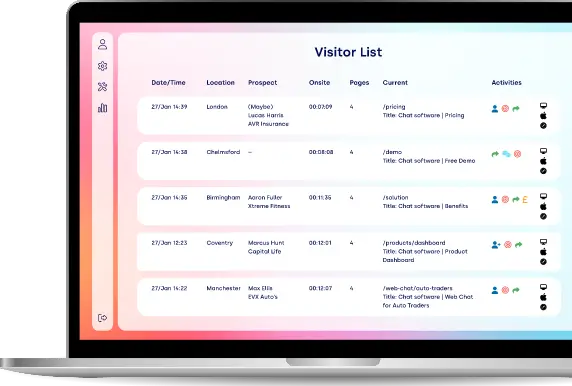

Proactively Engage Clients

Live chat is also a tool for proactively engaging clients who arrive on your site, similar to how an employee might greet them at the door in a brick-and-mortar branch. This approach might seem intrusive, but it’s something that customers like.

You’ll want to wait a few minutes before engaging a customer on your site via live chat. Give them some time to take everything in, and then offer to help them. 42 percent of all customers prefer live chat to other forms of communication.

Proactively engaging customers via other channels is virtually impossible unless you already have their contact details. And even then, it’s hard to pull off in a way that doesn’t feel awkward.

Provide Online Support In Real-Time

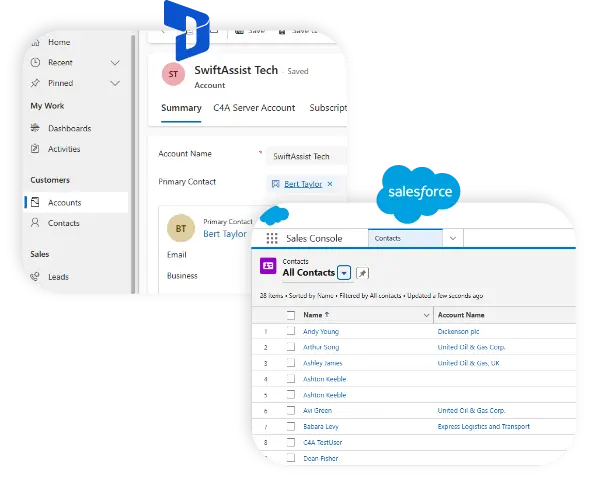

Being able to offer online support chat for website home pages is another reason why live chat is so essential for the finance industry. 75 per cent of people prefer it over any other channel. Customers see it as a key differentiator between brands and a real reason why they might use one over another.

Live chat is a critical strategy for building trust. Research shows that financial firms can use it to achieve this end rapidly, without having to go through a far longer, traditional process.

Reduce Support Costs

Today’s financial institutions also love live chat because it lets them reduce support costs significantly. The savings they generate can reduce prices elsewhere, helping them to become more competitive. Research from Forrester, for instance, found that live chat reduces phone support costs by up to 30 per cent. And that’s just the direct savings. Indirectly, live chat reduces other costs, such as training and equipment, too. It’s much easier to teach a rep how to use live chat than it is to get them to talk to real customers over the phone.

Chat To Customers Around The World

Phone-based reps can converse with customers in the local language, but things become trickier when discussing matters with those overseas. Language problems may hinder understanding.

Traditionally, the solution was to hire people from different countries and then build call centres across the globe. But only the biggest multinationals can afford to do that. Most other firms can’t.

That’s where being able to chat in customers’ native language helps. And live chatbots can do that with ease.

Keep Customers Engaged

Lastly, live chat is a great way to keep customers engaged. It makes it easy to start a conversation with them as they ponder whether to buy your products or services.

One option, for instance, is to create pre-chat surveys, something that’s rapidly gaining in popularity. Asking clients a few minor questions helps you direct them to the right person on your team. Clients who can’t get the information they want immediately will usually probe a customer service rep for support.

You can also use surveys after a chat to find out how successful your reps were. Customer feedback lets you identify their pain points and perhaps refine your current support policies and procedures.