The future of financial technology

Financial technology is developing across several dimensions. Blockchain and AI are reducing international transaction frictions, improving customer service, and improving service onboarding.

Financial technology is changing in exciting ways. Given the potential power of upcoming technologies, analysts aren’t entirely sure what will happen. However, the general consensus is that we will likely see significant disruption to existing business models.

For context, we have already seen significant technology-powered changes in the finance industry over recent years. New banks (and their apps) are already improving lives for consumers and bypassing some of the bigger (and less user-friendly) brands.

Wise, a London-based banking and finance startup, is a good example of this in action. Previously called Transferwise, this bank allows customers to hold dozens of currencies in their current account, and trade between them at the spot rate.

Monzo is another disruptive influence. This online bank, similar to Starling, has a powerful app that uses machine learning technology to show customers precisely where they are spending their money, automatically budgeting for them.

But, of course, the potential of technology to transform the finance industry is far greater than these examples alone. Right now, we are very much at the beginning of the journey.

Here we discuss some of the technology coming down the pike and how it could change both the consumer experience and industry structure dramatically.

Decentralised Finance

Decentralised finance is perhaps the single most disruptive prospect on the financial industry’s horizon. This technology promises to let users bypass trusted institutions and conduct complex transactions peer-to-peer.

The impact will likely be felt in developing markets with nascent banking systems first. Citizens will be able to trade with each other freely, having full belief in the safety and security of the transaction.

But changes will likely come to developed markets, too. Estimates on how long this process will take vary, but some pundits suggest that wholesale transformation could occur by 2050. The result could be an unrecognisable banking system where traditional gatekeepers no longer appeal. Why use a bank when you can transact safely without one?

Improved Chat Bots

Financial institutions have a customer service problem. According to research, 90 per cent are experiencing year-over-year declines in well-respected satisfaction indices. And, partly, that is the fault of poor customer service.

Right now, many financial institutions are still relying on chatbots that use an “expert systems” approach. These respond rigidly to customer inputs with stock answers which, usually, aren’t particularly helpful.

What's required is something that’s more human-like in its approach: something that can provide essential information regardless of the format of the question posed.

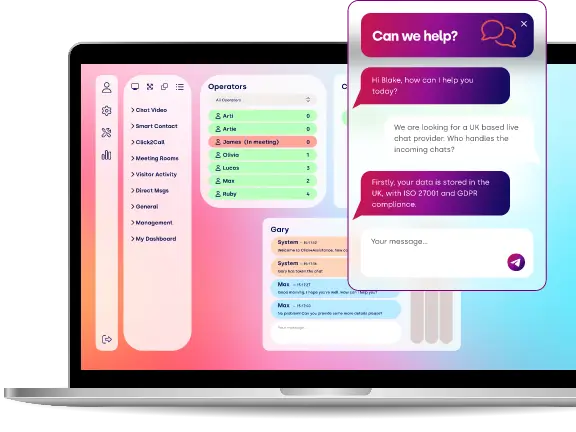

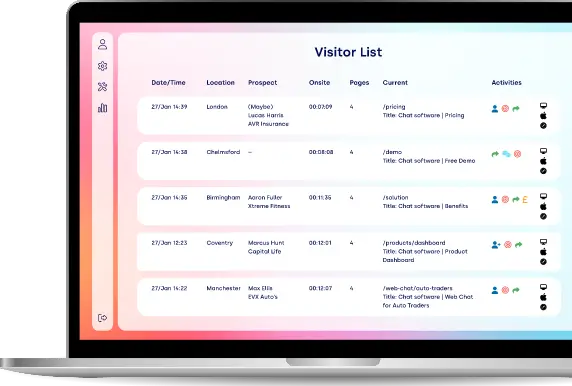

Fortunately, that technology now exists. Chat software for my website, for instance, has natural language processing built-in, which means that it can understand queries, even if users pose them in non-standard ways.

At present, these systems act as a kind of triage for incoming customers. Bots can answer basic queries while escalating more complex ones to human agents. But in the future, their ability to resolve issues will improve even more, and the need for conventional call centres may decline significantly.

Elimination of “Know Your Customer” Paperwork

“Know your customers” or KYC protocols are mandatory in many countries. But they are unpopular with customers. Users want to operate anonymously online, without having to hand over vast quantities of information about themselves to service providers.

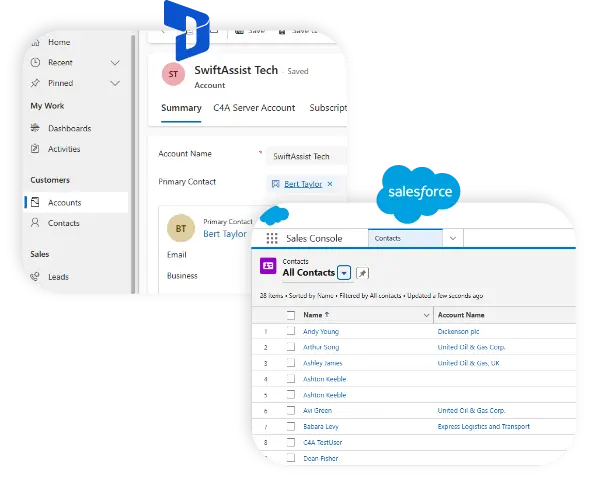

It’s unlikely that identification requirements will go away entirely. But technology could help make them more “invisible.” For instance, we could see the emergence of a system similar to single sign-on. Here, a trusted entity holds identification information in a cloud-based cache, and then users transmit that to financial institutions whenever they want to sign up for new products and services.

Embedded Finance

Lastly, we may see the emergence of embedded finance in platforms that, traditionally, did not associate themselves with the banking industry. In fact, you can already see companies moving in that direction.

Apple, for instance, introduced Apple Pay all the way back in October 2014 when it saw an opportunity to convert its handsets into payment cards. But now we’re seeing firms, like Twitter and Facebook with non-physical services enter the fray. Facebook Pay, for instance, is a way to pay for goods and services directly through the platform. And Elon Musk’s recent acquisition of Twitter paves the way for NFT, crypto and blockchain integration.

In summary, the future of financial technology looks bright. And, surprisingly, there are considerable opportunities for startups in the sector. We may be witnessing the last years of the traditional banking system.