The Role of AI in Helping Insurers Reduce Underwriting Costs

Discover how AI is revolutionising underwriting in the insurance industry, reducing costs, improving efficiency, and enhancing risk assessment. Learn more about the impact of AI on underwriting.

The insurance industry is undergoing a technological revolution, with artificial intelligence (AI) playing a key role in transforming underwriting processes. Traditionally, underwriting has been a time-consuming and resource-intensive task, requiring manual risk assessment, detailed data analysis, and decision-making by human underwriters. AI is now streamlining this process, reducing costs, improving efficiency, and enhancing the accuracy of risk assessment.

According to a report by Accenture, AI-driven automation in insurance underwriting could reduce operational costs by up to 40% while increasing underwriting efficiency by 25%. With 75% of insurers planning to adopt AI-powered underwriting tools this year, AI is no longer a future possibility – it is the present reality.

This blog explores how AI is reshaping underwriting in the insurance sector, its benefits, and the potential challenges insurers may face when implementing AI-driven solutions.

The Challenges of Traditional Underwriting

Underwriting is a crucial function in insurance, determining policy terms, premiums, and coverage based on an assessment of risk. However, traditional underwriting methods present several challenges:

- Time-Consuming Processes: Assessing risk manually requires extensive research and documentation, leading to delays in policy issuance.

- High Operational Costs: Underwriting teams require significant financial investment in personnel and training.

- Data Complexity: Insurers must analyse vast amounts of structured and unstructured data from various sources, including financial records, medical reports, and historical claims.

- Human Error and Inconsistencies: Manual underwriting increases the risk of errors and inconsistencies in risk assessment.

- Fraud Detection Difficulties: Identifying fraudulent applications and claims is challenging without advanced analytics.

AI is helping insurers overcome these obstacles by automating key underwriting functions and improving decision-making processes.

How AI is Transforming Underwriting

AI is revolutionising underwriting in multiple ways, from automating data analysis to enhancing risk prediction models. Here are the key ways AI is reducing underwriting costs for insurers:

1. Automating Data Collection and Processing

One of AI's most significant contributions to underwriting is its ability to automate data collection from multiple sources. AI-driven systems can quickly analyse financial records, credit scores, medical histories, and social media activity to assess risk profiles. This reduces the manual effort required, speeds up the decision-making process, and lowers administrative costs.

2. Enhancing Risk Assessment with Machine Learning

Machine learning algorithms can identify patterns and correlations within vast datasets, allowing insurers to improve the accuracy of risk assessment. By analysing historical claims and underwriting decisions, AI models can more effectively predict potential risks, leading to more precise premium calculations.

3. Fraud Detection and Prevention

AI-powered fraud detection systems can identify suspicious patterns in insurance applications and claims. By analysing behavioural data, transaction records, and inconsistencies in documentation, AI helps insurers detect fraudulent activity early, reducing financial losses associated with fraudulent claims. According to the Coalition Against Insurance Fraud, AI has helped reduce fraudulent claims by 18% in the last five years.

4. Improving Underwriting Efficiency with Natural Language Processing

Natural Language Processing (NLP) enables AI to analyse unstructured data more accurately, such as medical records and legal documents. AI can extract relevant information from lengthy reports, reducing the time required for manual document review. This improves efficiency and lowers costs associated with human labour.

5. Personalised Policy Pricing

AI enables insurers to avoid generalised risk categories and develop more personalised policy pricing. By assessing individual risk factors in real-time, AI-driven underwriting can offer customers tailored policies with more accurate premiums, improving customer satisfaction and reducing unnecessary risk exposure.

6. Reducing Administrative Costs

Automation in underwriting leads to a significant reduction in administrative expenses. AI-powered systems streamline document processing, automate routine tasks, and eliminate redundant workflows, allowing insurers to allocate resources more efficiently.

AI as a Communication Tool for Customers and Brokers

Beyond underwriting, AI also transforms how insurers communicate with customers and brokers. AI-powered chatbots and virtual assistants are critical in enhancing customer experience, reducing response times, and improving overall service efficiency.

7. AI Chatbots for Customer Interaction

AI-driven chatbots can respond instantly to customer enquiries, guiding them through policy applications, underwriting processes, and claims submissions. These chatbots operate 24/7, ensuring customers receive immediate support without human intervention. This reduces operational costs while enhancing customer satisfaction.

8. AI-Powered Assistance for Brokers

AI also benefits brokers by providing them with real-time insights and policy recommendations. Brokers can use AI-driven tools to quickly assess risk factors, compare policy options, and make informed decisions on behalf of clients. This improves efficiency and allows brokers to focus on providing personalised advice rather than administrative tasks.

Real-Life Examples of AI in Underwriting

Several insurers have embraced AI-driven underwriting solutions to enhance efficiency and reduce costs. For example:

- AXA has implemented AI to improve risk assessment and detect fraudulent claims, which has led to faster decision-making and reduced financial losses.

- Zurich Insurance has integrated AI into its underwriting processes to automate data extraction from medical and legal documents, significantly improving processing times.

- Aviva uses AI-driven chatbots to handle customer enquiries, reducing call centre costs and improving customer engagement.

These real-world applications demonstrate how AI is making a tangible impact on the insurance sector, offering measurable benefits for insurers and policyholders.

AI is transforming the insurance underwriting process by reducing costs, improving accuracy, and enhancing efficiency. From automating data collection to detecting fraud and personalising policy pricing, AI is helping insurers streamline their operations and deliver better customer service.

While challenges such as data privacy, integration with legacy systems, and bias mitigation remain, the benefits of AI in underwriting far outweigh the risks. As AI continues to evolve, insurers that embrace its potential will be well-positioned to stay competitive and drive innovation in the industry.

Click4Assistance: AI Chatbot Solutions for Insurers

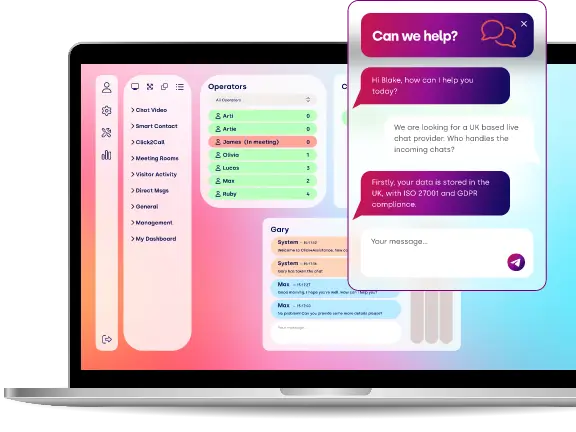

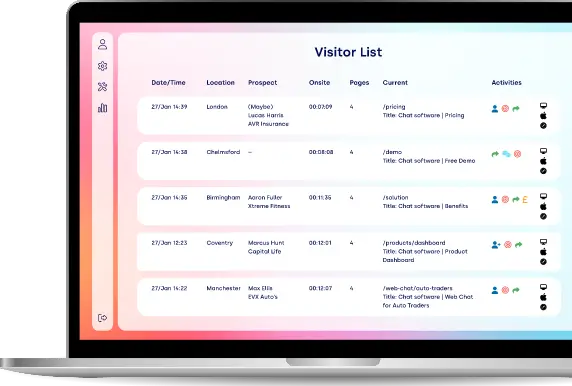

Click4Assistance is a leading provider of AI chatbot solutions designed to enhance customer engagement in the insurance industry. By integrating AI-driven chatbots into customer communication strategies, insurers can improve response times, streamline underwriting queries, and enhance overall customer satisfaction. Click4Assistance's chatbot technology ensures seamless interactions with customers and brokers, reducing the burden on human agents and allowing insurers to focus on high-value tasks.

Book a demo today to see how Click4Assistance's AI chatbots can transform your insurance business. Schedule your free demo now.