How To Save Money In The New Tax Year

Rising costs can potentially close down any business. Find out how to keep yours low.

Whether you're self-employed, have a partnership or run a company, one thought that's undoubtedly on your mind is how you can save money in the upcoming tax year. Rising operating costs are making life challenging for many sole traders and SMEs. But, it's not impossible to keep your costs down by adding live chat for your website and reducing your tax liability simultaneously. Take a look at the following ideas for some inspiration to get you started:

Simplify Tasks To Save On Staff Costs

Whether you sell goods or services, it makes no difference because there will always be some tasks that take up many resources in your business.

For example, you might have several call handlers to deal with customer services at your premises.

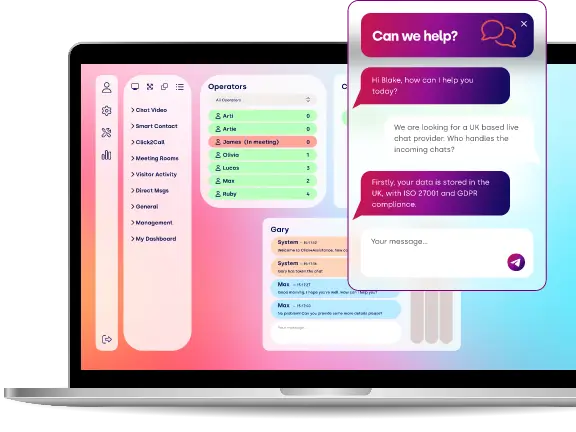

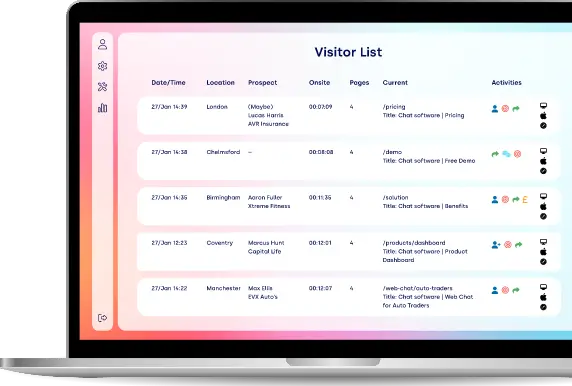

You could install a live chat for your website and direct customers to make enquiries online that way instead. A single call handler can deal with three simultaneous chat conversations, enabling you to reduce your customer service staffing costs.

Claim For All Eligible Expenses

There are several expenses you can claim on your tax return to reduce your annual liability as a business. The ones you can claim will depend on factors like the type of business you have and the type of tax liability you want to reduce.

The HMRC website gives information on allowable expenses. Alternatively, speak with your accountant to determine which expenses you should claim to make your business more tax-efficient.

Review Your Expenditure

Most business expenses can help reduce your tax liability. But, you should always check that you aren't overpaying for certain products and services vital to the operation of your business.

It's a good idea to periodically review your regular expenses and check whether you can save money by going elsewhere. Sometimes, you may find you could reduce your costs by adjusting subscriptions like digital services to better align with your typical usage.

Outsource Some Business Functions

Are you guilty of managing everything in your business in-house? If so, one thing you'll discover is how you are spending far too much money hiring people to perform certain functions in your business.

Instead, it can make more sense to outsource those functions elsewhere. Thanks to advances in technology, it's now possible to outsource all kinds of things from admin and IT services to manufacturing and prototyping.

Some of the most common things you can outsource include:

- Accounts - bookkeeping and filing of tax and company returns;

- Logistics - warehousing and deliveries;

- Call Handling - customer service and sales call centres.

Negotiate Better Rates With Suppliers

One final idea is to look at the contracts you have with suppliers and determine whether it's possible to negotiate better rates. If you've been using certain suppliers more often, it can give you the leverage you need to negotiate volume discounts.

Consider looking at alternative suppliers if your existing ones refuse to offer you better deals. Remember: you are their customer!