Consumers Still Feeling the Pinch After Christmas

Following Christmas, it can be a real time of worry for many consumers as millions face financial woes after overspending. It was previously reported that a third of Britons spent more than they could afford, while one in 10 paid for shopping through Credit.

Halifax Bank Research shows that:

- One in five admitted that they intended to spend more in 2017 than they did the year before

- 12% splash £1000 or over to celebrate December 25th and Christmas 2017 was estimated to cost people in the UK £20 billion.

- The biggest areas that consumers spend money on is gifts, Christmas dinner and alcohol

Why do Britons Overspend?

Families feel their biggest reason for overspending is the demands from children, wanting to please them with the latest toy or gadget so they don’t feel left out. This is followed by their own feelings of not wanting to miss out on Black Friday deals and other similar promotions.

Consumers would have also felt the pinch continuing into January, as many received their December paycheque early, meaning that the period between their December and January payday would have been extended, and therefore can rely on other methods to see them through the short term.

How Visitors Can Easily Gain Advice

Being in debit can be a difficult topic for consumers, therefore it can take a lot for them to reach out for advice. Many will feel embarrassed or apprehensive that they will be blamed for their situation, so it needs to be easy for them to approach organisations for help.

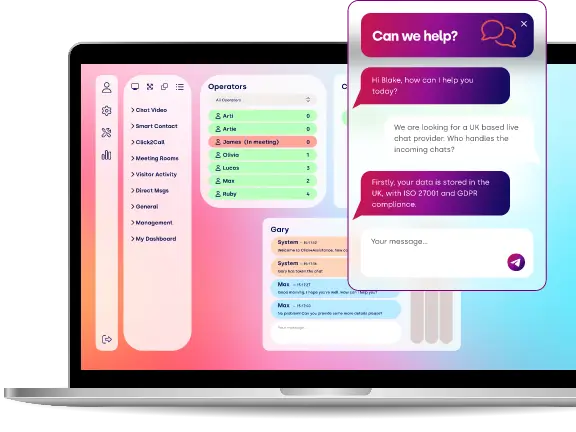

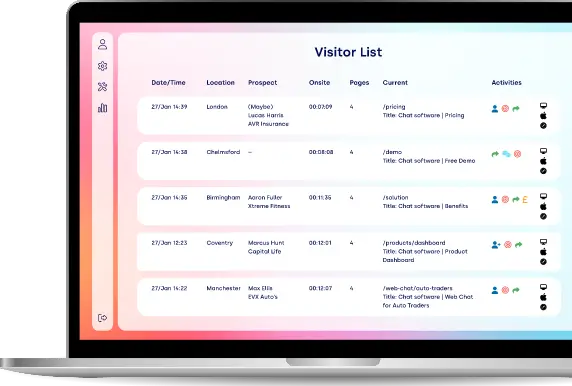

Live chat on websites has been proven to be a successful communication channel that increases consumer engagement. Visitors can have their questions answered quickly by a representative via text based messages.

Consumers are able to initiate a live chat session at a convenient time and place for them. As discussing financial information can be sensitive for many people, live chat provides a method that will not be overheard by others, helping consumers to feel more confident to open up about their situations.

Some people will prefer to keep their financial woes away from their partners and family members, therefore a live chat session can remain anonymous with no trail for the visitor, unless they request a transcript, unlike a phone call that will automatically appear on records. Whilst in chat, visitors can share the level of personal data they feel comfortable with, as some may not want to provide identifiable details to organisations.

How Organisations can Easily Provide Advice

Live chat on websites is a great channel for visitors, but it also holds many benefits for organisations. Firstly, the solution can be scaled accordingly to include as many concurrent users as necessary and the functionality as required.

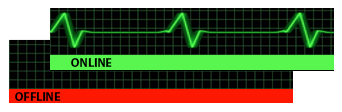

The status of the live chat system is determined by users logged in and their availability. The chat button will be in its offline mode when all operators are logged off or are set to unavailable. Organisations can either present a call form or as visitors are less likely to share their details, display their chat operational hours or hide the button altogether.

To help people with managing their finances, organisations such as the Citizens Advice Bureau and the National Debtline will have guides and information published. These can be transferred to the visitor by using functionality available within the solution, including Pre-defined Replies, File Transfer and Auto Navigate. This ensures that the visitor is getting the agreed and relevant information in a timely manner.

Click4Assistance has been providing live chat on website software to financial companies for over 10 years. For more information about how the solution can help organisations provide advice, contact our team on 01268 524628 or email theteam@click4assistance.co.uk.

Sources:

http://www.mirror.co.uk/money/1-4-brits-spend-much-6970163

https://www.blog.noddle.co.uk/finance/brits-going-big-spenders-christmas/