Money Saving Ideas For Business

Conditions are challenging for UK businesses in the second half of 2022. However, there is substantial government support and relief available for firms that know where to look.

Conditions for businesses in the UK market are challenging. Citi is predicting that inflation will top 18 percent by March 2023, and Trading Economics Global believes that natural gas prices will trade at more than £727 per therm (up from just £25 per therm in 2019), pushing up energy costs dramatically.

Fortunately, help is available. Here are some money-saving ideas for your business.

Get a Discount of up to £5,000 on Software with Help to Grow: Digital

Help to Grow: Digital is a government-backed, UK-based scheme that lets small and medium-sized businesses get access to discounted technologies to help them grow. Qualifying firms can get 50 per cent off approved software, up to a maximum value of £5,000.

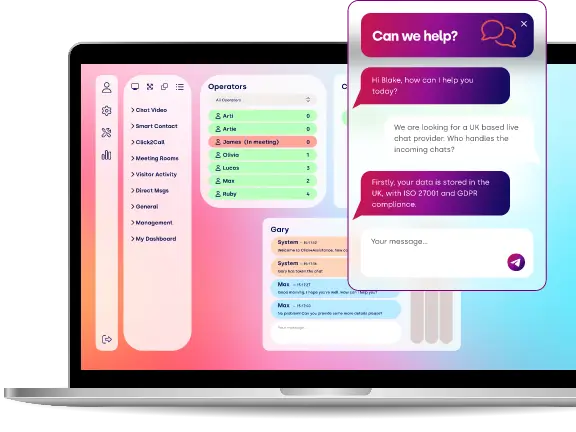

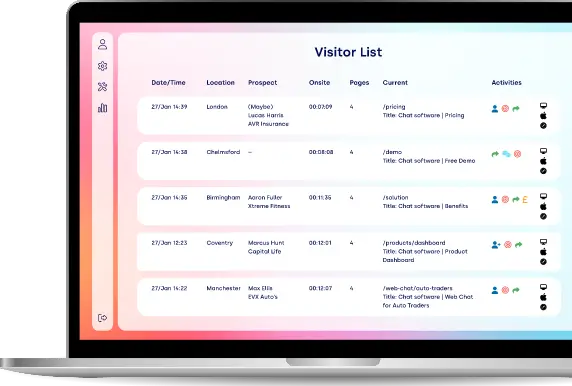

Added to this, Help to Grow: Digital offers free and impartial advice to companies considering whether they should adopt new software. The service provides guidance on choosing which technologies are best, tools to compare different software, and case studies explaining how existing firms benefited from the scheme. Getting live chat integration website tools has never been easier.

To qualify, your company must employ between 1 and 249 people. It must also be registered with Companies House and have been actively trading before the discount came into effect on 20 January 2022. If you have purchased software for your business before, you do not qualify. You do not have to pay for any official consulting or advice you receive.

Get A 50 Per Cent Discount on Business Rates

Thanks to budget changes, businesses in retail, hospitality, and leisure may qualify for discounted rates. The rules allow firms to get 50 per cent off their rates bills for the 2022 to 2023 tax year up to a maximum value of £110,000. Any dues above the threshold will be payable at the standard rate.

In total, there are more than 440,000 commercial properties across the country that stand to benefit from business rate savings. In total, firms would be more than £1.7 billion better off as a result of the new scheme.

To help businesses further, the government is also freezing business rate multipliers until 31 March 2023, keeping them at the 2020/2021 tax year level.

HMRC uses multipliers to calculate how much business rates should rise each year, given the prevailing rate of inflation. Under normal circumstances, these rates would increase in line with the CPI, implying 50.2p for small properties, and 51.5p for larger ones. However, multipliers will remain at 49.9p for small businesses and 51.2p for all other firms following the freeze, saving businesses approximately £4.6 billion over the next five years.

Lastly, eco-friendly businesses may be able to apply for further relief on top of that already outlined for traditional firms. This year, there will be no business rates for firms that use green technology to decarbonise buildings. Businesses that install solar panels, batteries and eligible heat networks won’t have to pay anything, potentially saving around £200 million over the next five years.

Invest In Your Business With Super-deduction and Annual Investment Allowance

Lastly, if your company invests in plant and equipment, you may be able to significantly reduce your tax bill by using:

- The Super-deduction

- Annual Investment Allowance.

The Super-deduction

The Super-deduction came into force on 1 April 2021 and will continue until 31 March 2023. Companies investing in qualifying machinery will be able to claw back 25p on their tax bill for every £1 they invest. Firms can reduce their tax bills when they purchase commercial vehicles, computers, office furniture, and other items that generate business income. The government believes that the scheme makes the UK capital allowance one of the most competitive in the world.

The government introduced the Super-deduction in the wake of the COVID-19 pandemic. The assistance was designed to give firms more confidence in making business investments during a period of profound uncertainty. The rules incentivise companies to build out their plant and equipment now instead of waiting for volatility to subside.

Annual Investment Allowances

Annual Investment Allowances (AIAs) have been around in one form or another since 2008. However, the government recently extended the record £1 million limit until the end of March 2023, giving businesses even more opportunities to cut their tax bills.

Under AIA rules, firms can deduct the full value of qualifying AIA items from their profits before tax. Most capital spending on plant and machinery applies, up to the value set by the AIA amount. (You can’t claim for items given to your business, company cars, or items you started using before using them in your business).

In 2008, the AIA amount was just £50,000. It rose to £100,000 in 2010 and was £500,000 by 6 April 2014. In January 2016, the government set the rate to £200,000 before raising it to more than £1 million by 1 January 2019.

Under AIA, you can only make a claim if you purchased an eligible item in the qualifying period. You cannot make claims for plant and equipment bought before 1 January 2019.

If you buy an item under contract purchase, you aren’t allowed to claim interest payments. Furthermore, you must only claim payments you have not yet made when you start using the item.

If you are a sole proprietor or partnership and you own more than one of these entities, you can qualify for an AIA for each. However, if you own two or more companies that pay corporation tax, you must share your AIA between them.

Both their Super-deduction and Annual Investment Allowance will remain in place until March 2023. That means that businesses still have a long time to take advantage of capital savings. The government may extend the deadline, but no such announcement has yet been made. Therefore, businesses should make eligible investments now to take advantage of the benefits.