The Benefits of Omnichannel Chatbots for Financial Services

Discover how omnichannel chatbots transform financial services by enhancing customer engagement, improving efficiency, and ensuring smooth interactions across multiple platforms.

The financial services sector is undergoing rapid digital transformation. As customer expectations evolve, financial institutions must adopt innovative solutions to provide efficient, effective, and secure interactions. AI-driven omnichannel chatbots are emerging as a vital tool in this evolution, offering enhanced customer engagement, improved operational efficiency, and consistent support across multiple communication channels.

Enhancing Customer Experience Through Omnichannel Chatbots

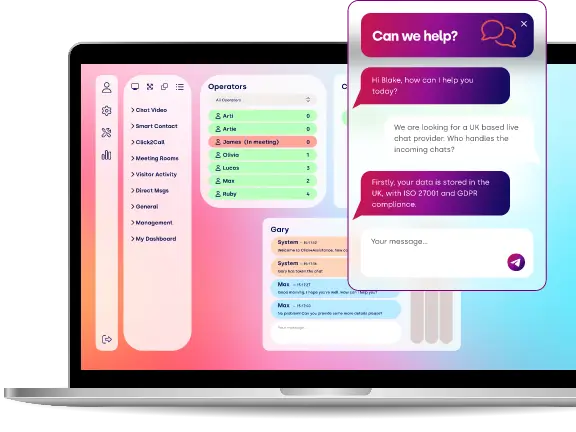

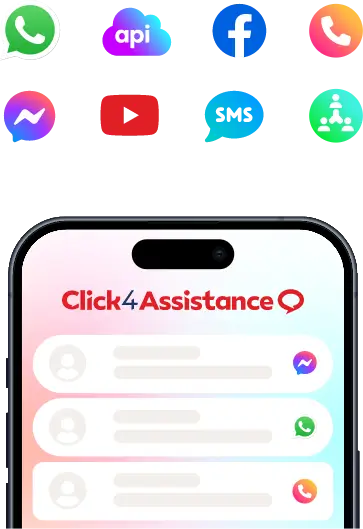

Customer experience is at the heart of financial services, and omnichannel chatbots significantly improve this aspect. They provide real-time, personalised banking assistance across various platforms, ensuring that customers receive consistent and accurate support. Whether interacting via a website, mobile app, social media, or messaging platforms, customers experience a unified digital banking journey.

A key advantage of omnichannel chatbots is their ability to retain conversation history across different channels. If a customer begins an enquiry on a website chat and later continues it through WhatsApp, the chatbot continues the conversation without losing context. This eliminates the need for customers to repeat themselves, reducing frustration and improving overall satisfaction.

Improving Operational Efficiency and Cost Reduction

Financial institutions face increasing pressure to improve efficiency while managing costs. Omnichannel chatbots powered by AI automation streamline operations by handling high volumes of customer interactions without human intervention. They can respond to common banking queries, process transactions, and guide customers through complex financial processes, allowing human agents to focus on more strategic tasks.

AI chatbots are projected to save businesses up to $11 billion annually and reduce nearly 2.5 billion hours of customer service time by 2025.

24/7 Availability for Uninterrupted Support

One of the major advantages of chatbots in financial services is their round-the-clock availability. Customers expect immediate responses, especially when dealing with urgent financial matters. Unlike traditional support teams with limited working hours, chatbots provide instant AI-powered assistance at any time of the day or night. This level of accessibility enhances customer trust and satisfaction.

Additionally, Click4Assistance chatbots can escalate complex queries to human agents when necessary. By transferring conversations efficiently and providing context-rich insights, they ensure a smooth transition and prevent customers from experiencing delays or repeated questioning.

Strengthening Security and Compliance

Security is a top priority in the financial sector. Omnichannel chatbots are designed with robust security protocols to protect sensitive customer information. Features such as two-factor authentication, encryption, and secure API integrations ensure that data remains confidential, and transactions are conducted safely.

Chatbots also assist with regulatory compliance, ensuring adherence to financial regulations such as GDPR and FCA guidelines. Automating processes like identity verification, fraud detection, and transaction monitoring minimises human error and strengthens security in digital banking.

Personalisation and Data-Driven Insights

Financial institutions rely on data-driven AI solutions to deliver personalised services. Omnichannel chatbots leverage machine learning to analyse customer interactions, preferences, and behaviours. This enables them to offer:

- Tailored investment recommendations

- Proactive fraud alerts

- Personalised financial advice.

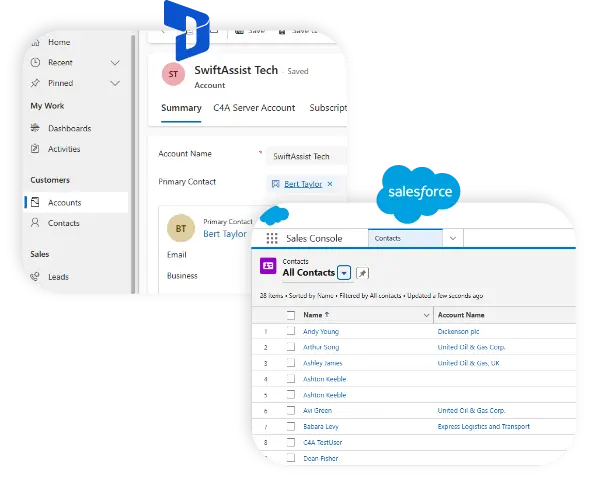

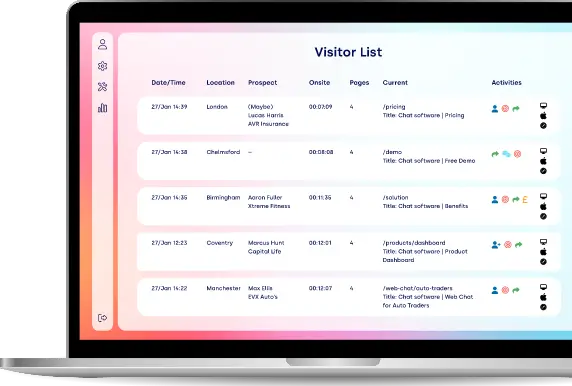

Integration with Existing Financial Systems

Omnichannel chatbots integrate smoothly with banking and financial systems, including CRM platforms, payment gateways, and knowledge bases. This enables them to provide real-time updates on account balances, loan applications, and financial product details, empowering customers with self-service options.

By linking with back-end systems, chatbots can also automate:

- Loan applications

- Credit score checks

- Fund transfers

- Mortgage enquiries

The Future of Omnichannel Chatbots in Financial Services

As technology advances, omnichannel chatbots will become even more sophisticated. Future developments may include:

- Enhanced voice assistant integration (e.g., Alexa, Google Assistant)

- Predictive AI analytics for risk assessment

- Advanced fraud detection and prevention

- AI-driven virtual financial advisors.

Financial institutions that embrace chatbot technology today will gain a competitive edge, improve efficiency, and meet the evolving expectations of a digital-savvy customer base.

Click4Assistance: Your Trusted AI Chatbot Partner

AI-powered omnichannel chatbots are transforming financial services, providing instant customer support, cost-saving automation, and increased security. Financial institutions adopting chatbot technology now will be well-positioned to thrive in a digital-first economy.

Click4Assistance is a leading provider of AI-powered chatbots for the financial services industry. Our secure, FCA-compliant chatbots provide a smooth customer experience, enhance operational efficiency, and help financial institutions reduce costs.

Why Choose Click4Assistance?

20+ years of experience in AI chatbot technology

Custom-built financial services chatbots

Fully compliant with GDPR and FCA regulations

Integration with banking & CRM systems

Ready to transform your financial services? Contact Click4Assistance today for a free chatbot consultation. Book a demo.