How AI agents can benefit insurance underwriters

The insurance industry is built on precision, speed, and customer trust – and nowhere is that more crucial than in underwriting. Underwriters evaluate risk quickly and accurately, ensuring policies are both fair and profitable. Insurance companies must also deliver smooth customer experiences in a fast-paced digital world.

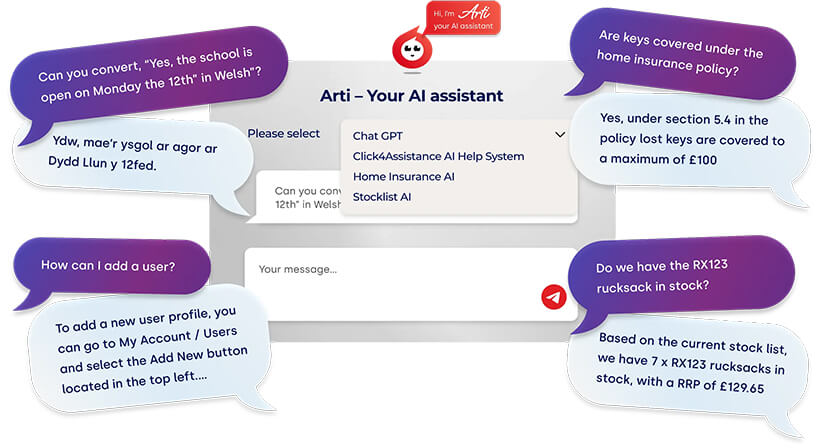

This is where Arti, the AI agent from Click4Assistance, steps in to make a measurable difference.

Designed to enhance efficiency and engagement, Arti offers insurance underwriters a powerful new way to streamline operations, reduce manual workload, and deliver exceptional service.

Meeting the new expectations in insurance

Today’s insurance customers expect rapid responses, personalised service, and easy digital experiences. Meanwhile, underwriters are pressured to process increasing applications and queries without sacrificing quality or compliance.

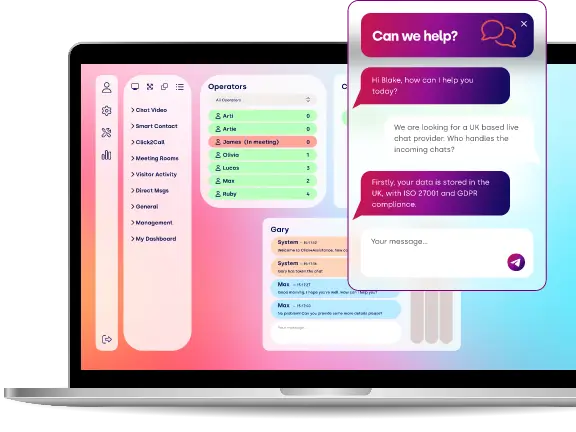

Arti is built to help underwriters meet these demands head-on, offering instant, accurate, and 24/7 support. Powered by ChatGPT technology and hosted securely in the UK, Arti helps customers and empowers underwriters and support teams to work smarter.

Key benefits of Arti for insurance underwriters

1. Instant answers for faster decisions

Underwriters often field questions from brokers, agents, and clients that could delay risk assessments if not answered swiftly. Arti can deliver immediate, accurate responses to common queries – such as underwriting guidelines, policy criteria, or documentation requirements – without underwriters stepping away from more complex decision-making tasks.

Arti frees underwriters to focus on higher-value, strategic risk evaluations by handling routine enquiries.

2. Streamlining data collection

Accurate underwriting depends on gathering complete and correct information. Arti can guide applicants or brokers through information gathering, ensuring all required fields are completed and validating inputs in real-time. This speeds up the underwriting process and reduces the risk of incomplete or inaccurate submissions.

Fewer errors at the start mean quicker, more reliable underwriting decisions.

3. Triaging complex cases

Arti is designed to intelligently handle initial interactions, collecting key details before passing more complex or unusual cases to a human underwriter. This triage system ensures that simple cases are processed quickly, while complex ones receive the detailed human attention they deserve – improving overall case flow and customer satisfaction.

4. Enhancing customer experience

Insurance can sometimes feel impersonal or complicated. With Arti, customers benefit from natural, human-like conversations that guide them through the process with clarity and empathy. Arti’s ability to be customised to your brand’s tone – professional, friendly, or supportive – ensures that every interaction aligns with your company values and service standards.

A smoother, more approachable experience helps build customer trust, improving retention and brand reputation.

5. Supporting underwriters with knowledge access

Arti is not just a customer-facing tool. He provides invaluable internal support by giving a real-time knowledge base for underwriters and support teams. Staff can query Arti for quick clarification on underwriting rules, regulatory requirements, or internal processes, improving accuracy and speeding up decisions.

This continuous access to information helps underwriters stay sharp and up to date – without interrupting their workflow.

6. Maintaining security and compliance

With sensitive client information at stake, data security and GDPR compliance are non-negotiable in insurance. Arti is hosted entirely in the UK and built with robust security protocols, ensuring that all interactions comply with industry regulations. Your data stays protected, giving you and your clients peace of mind.

7. Scaling with business growth

As your underwriting team and client base grow, Arti grows with you. Whether handling more frequent quote requests, processing new insurance lines, or adapting to new underwriting rules, Arti’s scalable technology ensures staffing bottlenecks never limit you.

Automation allows you to maintain service levels even during busy periods – such as new product launches or peak renewal seasons.

Real-world applications for Arti in underwriting

Quoting assistance: Arti can help gather initial customer information for quoting purposes, ensuring that underwriters receive well-prepared submissions.

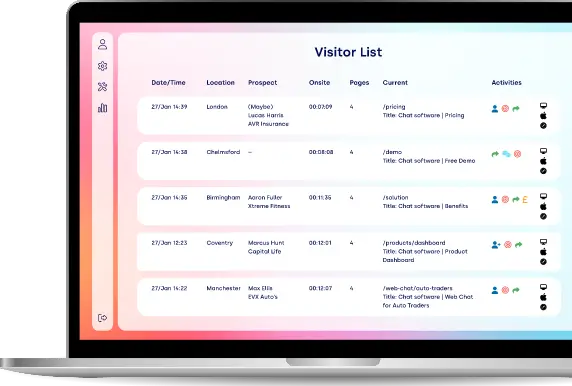

Pre-qualification: By screening prospects against underwriting criteria, Arti can identify qualified applicants and reduce wasted time on unsuitable submissions.

Renewal support: Arti can proactively reach out to clients at renewal periods to collect updated information, answer questions, and facilitate renewals.

Knowledge training for staff: New underwriters or support agents can interact with Arti to learn policies and procedures faster, reducing training time and costs.

Handling broker queries: Brokers seeking clarification on risk appetite or documentation requirements can get instant assistance through Arti, reducing inbound call volume.

Why choose Arti for your insurance business?

Built for the UK market: Hosted and supported in the UK with full GDPR compliance.

Human-like interaction: Powered by ChatGPT for natural, intelligent conversations.

Quick deployment: Easy to train using your underwriting guides, FAQs, and documentation.

Customisable: Adapt Arti’s persona and language to match your brand.

Proven expertise: Backed by Click4Assistance’s 20+ years of customer engagement innovation.

Getting started with Arti

Implementing Arti is straightforward. Upload your underwriting manuals, policies, FAQs, and relevant website links, and Arti quickly learns the information he needs to support your team and your customers.

From there, you can customise responses, set escalation triggers for human handover, and continuously refine Arti’s knowledge based on real-world usage.

Final thoughts

The insurance sector is evolving rapidly, and underwriting is under more pressure than ever to balance speed, accuracy, and customer satisfaction. AI-powered tools like Arti offer underwriters a smarter way to manage workloads, improve decision-making, and deliver a first-class service experience.

By streamlining processes, empowering staff, and enhancing customer engagement, Arti is not just a chatbot but a strategic partner for modern insurance businesses.

Ready to transform your underwriting process with a chatbot?

Discover more about Arti today at www.click4assistance.co.uk/chatbot-ai-arti