Revolutionizing Financial Conversations Instantly: The Future of Live Chat in Finance

In the ever-evolving landscape of financial services, one tool is emerging as a game-changer in the realm of customer engagement: live chat. With its ability to provide instant, human-like conversation, discover how to add a chat feature to my website and the way it’s redefining how finance professionals interact with their clients and customers.

This comprehensive exploration of how to add a chat feature to my website in the finance industry will delve into its benefits, challenges, and future trends, offering invaluable insights for bankers, fintech enthusiasts, and anyone invested in the future of finance.

Introduction

As finance pivots further into the digital realm, the options for direct communication between financial institutions and their customers are expanding. Gone are the days of picking up the phone for every inquiry, only to be put on hold for uncertain periods. Live chat now offers immediate accessibility and a conversational mode that resonates with the preferences of today's tech-savvy users.

The significance of live chat extends beyond mere convenience. It is a potent tool for enhancing customer service, simplifying the user experience, and facilitating real-time financial discussions. Moreover, the deployment of live chat can lead to substantial cost savings and operational efficiencies, making it an attractive prospect for banks, fintech startups, and established financial service providers.

Benefits of Live Chat in Finance

Enhanced Customer Service

Finance is rooted in trust and transparency, and nothing communicates these values better than a direct, two-way conversation. Live chat allows finance professionals to engage with clients on a personal level, addressing their concerns immediately and fostering trust in the institution's commitment to their needs.

In an era where customer churn is just a click away, exceptional service is a primary differentiator. Live chat enables financial brands to offer support that's both quick and comprehensive—essential for retaining existing customers and attracting new ones.

Improved User Experience

Finance can be complex, riddled with jargon and intricate jigsaw puzzles of information. Live chat simplifies the process by providing a conversational interface that navigates users through their financial queries with ease.

The user who requires assistance in understanding the intricacies of a tax return or the terms of a new investment can find the help they need without the hassle of searching through an extensive FAQ page or waiting for an email response. Such instantaneous support transforms the user experience and sets a precedent for service quality that customers remember and appreciate.

Real-time Problem Resolution

A swift resolution to a pressing financial issue can significantly impact a customer's satisfaction and loyalty. Live chat excels in this arena, offering the immediate problem-solving capabilities necessary for urgent matters.

From authorizing a blocked transaction to clarifying a mysterious fee, live chat agents can address a wide range of issues in real time, sparing customers the frustration of delays and uncertainties. In doing so, they not only bolster customer satisfaction but also reduce the workload on traditional support channels, ensuring that high-priority cases receive the prioritized attention they deserve.

Cost Savings and Efficiency

The automation and centralization of live chat systems offer financial institutions substantial cost savings compared to traditional call centres. Operating 24/7 with AI-powered bots, live chat can handle a significant portion of customer interactions, reducing the need for extensive human staffing.

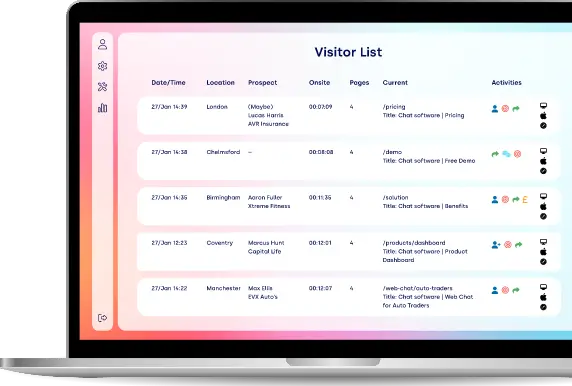

Beyond the cost aspect, live chat enhances operational efficiencies. Conversations can be saved and reviewed for training or quality assurance purposes, and analytics tools provide valuable insights into customer needs and common issues, which in turn can inform better practices and the development of self-service resources.

Use Cases and Examples

To truly grasp the value of live chat in financial services, examining its diverse use cases across different sectors is crucial. Let's explore how live chat is being leveraged in several key areas.

Live Chat for Account Inquiries

Imagine an interface where customers can inquire about their current account balance, statement details, or any recent transactions instantaneously. This real-time service is not only convenient but also vital in detecting and resolving any potentially fraudulent activities.

Fintech startups have been quick to adopt live chat for account-related queries, often coupling it with AI-powered systems that can recognize patterns indicative of fraud or unusual account activity, alerting the user and support staff immediately.

Live Chat for Loan Applications

Loan applications have always been a gateway to growth and opportunity for individuals and businesses. However, the application process can be daunting, involving numerous documents and a thorough review process. Live chat steps in to simplify and speed up this vital procedure.

Institutions like credit unions and online lenders have embraced live chat to assist prospective borrowers through the application journey, explaining requirements, gathering forms, and providing real-time updates on the status of their applications. The result is a user-centric experience that enhances the loan application process for all parties involved.

Live Chat for Investment Advice

The arena of wealth management and investment is where live chat's personalized interaction truly shines. Advising on complex financial portfolios or suggesting the best investment options demands a thoughtful dialogue that considers the client's unique circumstances and ambitions.

Financial advisors who integrate live chat into their services can maintain more frequent and meaningful interactions with their clients, offering advice that is both timely and tailored. This level of outreach goes a long way in retaining investor confidence and furthering the client-advisor relationship.

Live Chat for Fraud Prevention

Live chat plays a pivotal role in fraud detection and prevention, providing a direct means for financial institutions to communicate with customers about suspicious activities.

Interactive pop-ups on banking apps, for example, now allow customers to report a lost or stolen card immediately, communicating directly with an agent who can freeze the account and advise on the next steps. This swift action can prevent significant losses and demonstrates the value of live chat in rapidly responding to security threats.

Challenges and Considerations

As promising as the prospects of live chat in finance are, its implementation is not without hurdles. Financial institutions must carefully navigate several key challenges to ensure the success and safety of live chat systems.

Security and Data Privacy

Protecting sensitive financial information is paramount, and any communication channel, including live chat, is susceptible to security breaches. Institutions must invest in robust encryption and secure data handling practices to mitigate the risk.

Furthermore, compliance with data protection regulations such as GDPR and the upcoming CPRA is non-negotiable. Live chat implementations must be cognizant of these privacy laws and work to ensure that customer data is handled with the utmost care and transparency.

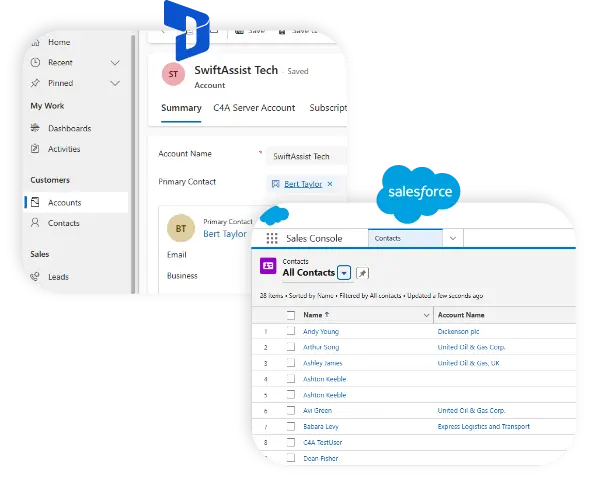

Integration with Existing Systems

For legacy financial systems, the integration of live chat can be complex and require substantial resources. Ensuring that live chat is seamlessly connected to existing databases and customer relationship management (CRM) platforms is essential for providing consistent and informed service.

Institutions should invest in flexible and scalable live chat solutions that can adapt to their existing infrastructure and collaborate closely with IT teams to troubleshoot any issues that arise during integration.

Training and Staffing

For live chat to be effective, the staff responsible for managing it must be well-trained in both financial products and the subtleties of online customer engagement. This operational challenge requires a concerted effort towards selecting, training, and retaining the right talent.

Investing in ongoing education and creating clear guidelines for communication will help live chat agents provide a service that is both professional and personable, maintaining the vital human element that sets live chat apart from other digital channels.

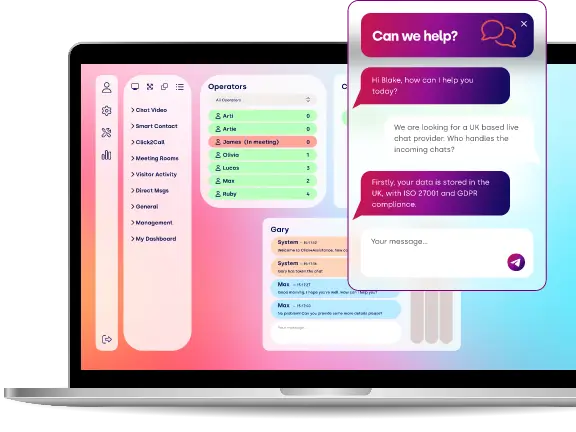

Balancing Automation and Personalization

While AI-driven chatbots can handle a large volume of routine customer inquiries, the risk of appearing impersonal or providing incorrect information is a concern that must be addressed. Finding the right balance between automation and human intervention can be a delicate process.

Well-designed chatbot systems should include clear escalation paths for complex queries, ensuring that the final touchpoint with the customer is person-to-person. Regular review and updating of chatbot responses are necessary to maintain accuracy and relevance.

Future Trends in Live Chat for Finance

Looking ahead, the future of live chat in finance is poised to be more advanced and integrated than ever before. Several emerging trends are set to redefine the role of live chat in financial services.

AI-Powered Chatbots

Artificial intelligence is advancing at a rapid pace, and AI-powered chatbots are becoming increasingly sophisticated. Conversational AI models are now capable of understanding complex human language and providing more nuanced responses.

These advancements will lead to chatbots that can take on bigger roles in customer service, handling more sensitive financial inquiries with a high degree of accuracy. They will also become better at recognizing when to hand off to a human agent, ensuring a seamless experience for the customer.

Voice and Video Integration

The addition of voice and video capabilities to live chat will introduce new dimensions to client interaction. With the rise of digital assistants and voice-activated devices, consumers are becoming more comfortable with non-textual forms of communication.

Voice and video integration will allow for more dynamic and personalized interactions, such as virtual meetings with financial advisors or the use of video for demonstrating complex financial concepts. These channels will become crucial in delivering a holistic and engaging customer experience.

Omnichannel Support

The future of live chat in finance lies in its integration with a wider array of communication channels, resulting in a truly omnichannel support system. Customers will be able to transition seamlessly from chat to email to phone, with their conversation history and context maintained across all channels.

This continuity of service will be a key differentiator for financial institutions, offering customers the flexibility to choose the method of interaction that suits them best, without sacrificing the quality or continuity of their service.

Conclusion

Live chat is not just a trend; it's a transformative tool that has the power to redefine customer engagement in the finance industry. By combining the immediacy of digital communication with the personal touch of a traditional banking interaction, live chat offers a unique blend of efficiency and empathy that resonates with the demands of modern consumers.

The potential for live chat to enhance the financial experience and improve operational effectiveness cannot be overstated. As the finance industry continues its inexorable march toward digital transformation, live chat is set to be an indispensable part of the journey. It is incumbent upon finance professionals to embrace and harness the power of this technology, ensuring that they remain at the forefront of the fintech revolution.

For those eagerly navigating the complexities of live chat in finance, the future is bright with possibility. It is a future where financial conversations, complex or simple, take place instantly and seamlessly, engendering a new era of trust and convenience in financial services. Embrace the change and be part of the transformation that live chat brings to the finance world. Your customers and clients are only a chat window away from their next financial success.

Join the Fintech Revolution with Our Live Chat