What Can AI Achieve Within the Finance Industry?

Ultimately, if businesses are able to better serve their customers, they are able to deliver greater results. Leading banks are choosing to experiment with new and emerging technologies to help achieve this, whilst many finance companies are more wary to invest.

Artificial Intelligence (AI) is one of these technologies that hold huge benefits for finance companies to improve their internal processes and service to customers, however it has not been widely introduced. Businesses can introduce AI to prequalify a visitor before the conversation is referred to a human operator. This reduces the time that the representative spends answering repetitive questions before they can actually advise a customer.

For example, an insurance company can use a chatbot to ask visitors questions such as:

- What would they like to do? (Purchase a policy, renew a policy, change a policy etc.)

- What type of insurance? (car, van, bike or home)

- How many years no claims do they hold?

Whereas an authorised payment institution (API) or bank may want to use it to find out the nature of the enquiry (open a current account, get a loan, change details on a mortgage account) and if they are an existing customer.

This information is passed directly to a human representative who can then continue the conversation based on the visitor’s answers. Whilst the chatbot is asking the pre-qualifying questions, a supervising operator can be using the time to look up any existing customer details within their database, ensuring that the flow of conversation continues smoothly.

Another way that AI can be integrated into finance companies’ live chat for website systems is that the chatbot can answer frequently asked questions. For example:

Insurance company Go Skippy’s frequently asked questions include:

- What insurance products do you offer?

- What levels of cover are there?

- What are classes of use?

Whereas authorised payment institution, CardOneBanking has:

- How long does it take to switch your account?

- How do I switch my account to CardOneBanking?

- Does everything on my old account get switched to my new account?

Allowing a chatbot to answer these types of questions reduces the involvement of a representative. In most cases they are repeating the information already available on the website, and therefore automating this saves the organisation’s resources for more in-depth enquiries.

Click4Assistance’s AI Development

Just like the finance companies that were wary to invest in the new and immature technology, the Click4Assistance team also had apprehensions of existing systems offered by other providers, mainly their reliability. Therefore we have spent a considerable amount of hours and money thoroughly researching and developing our own complete AI service.

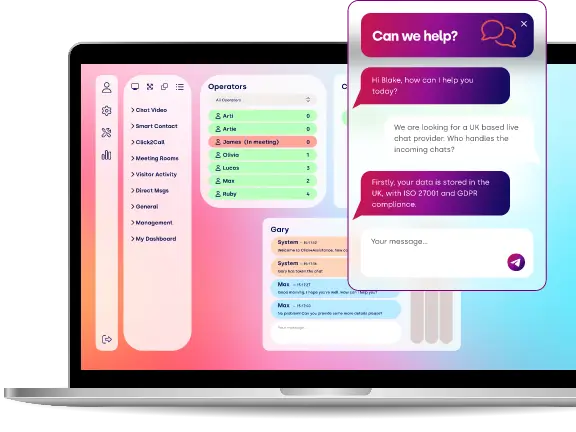

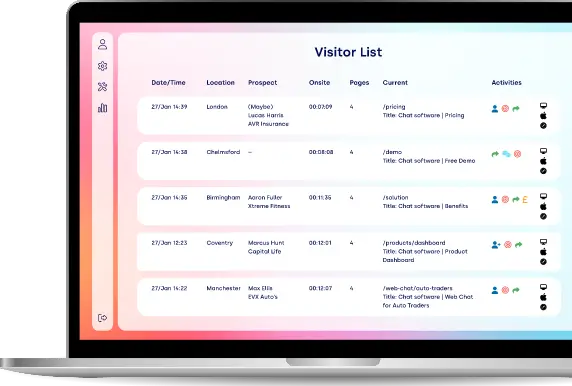

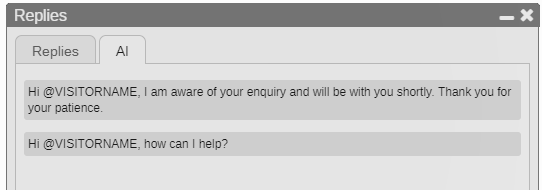

Phase 1 was introduced at the beginning of the year, with Assisted AI included within the new enhanced solution ‘Experiences’ by Click4Assistance. The functionality runs an algorithm that matches what the visitor is typing to the library of pre-defined replies; this then presents the responses in order of relevance to the human operator, who can choose if they want to use one of the suggested replies. These can be qualified and edited before being sent to the enquirer, ensuring their question has been answered fully and accurately, whilst still reducing the representative’s response rate.

Moving onto phase 2, six months after the foundation for AI had been completed the development team are finalising a full AI service. As part of the research period our development team looked into platforms such as Watson by IBM, Microsoft’s Lewis and Google’s AI solution. The system has been built up step by step to ensure reliability remains a strong element throughout each stage, rather than releasing a chatbot that cannot provide the expected service as it’s trying to process at a far more complex level than it’s capabilities.

The functionality will be available shortly however our research and development won’t stop there. We will continue to investigate ways to increase the chatbots functionality ensuring your customer service meets and exceeds customers’ expectation at every stage of automation.

Did you know?

Discussions have arisen within the Click4Assistance team regarding what salutation the chatbot should be entered into the system under. As the technology is gender neutral the most commonly recognised title is Mx and is accepted by government and other organisations throughout the UK.

It was reported in 2017 that HSBC had introduced 10 gender neutral titles for customers, these include:

- Mx – pronounced mix or mux. The x replaces the end of Mr, Mrs, Miss and Ms and leaves a person’s gender unstated

- Ind – abbreviation of individual

- M – The letter M – dropping the end of Mr, Mrs, Miss and Ms

- Misc – Abbreviation of miscellaneous

- Mre – Abbreviation of mystery or ‘mistree’

- Msr – Pronounced miser. Represents a combination of Miss and Sir

- Myr – Pronounced meer. Used in other parts of the world

- Pr – Pronounce Per. An abbreviation of person.

- Sai – Pronounced sigh. Used in Asia

- Ser – Pronounced Sair. Used in Latin America

The bank introduced the 10 so that customers could choose what they feel most comfortable with whilst be addressed. However as our chatbot cannot decide for itself, we will be giving it the title of Mx.

Further research into this also uncovered that those who identify as species neutral can be referred to as free-being or gentle-being. You learn something new every day!

To learn more about Click4Assistance’s AI service and/or our live chat for website solution, contact our team on 01268 524628 or email theteam@click4assistance.co.uk.